Tax aspects of M&A in France

The mergers and acquisitions (M&A) market rebounded in France in the first semester of 2024 (+ 26% increase in volume) but the dissolution of the National Assembly introduced some political and economic uncertainty.[1] It is likely that the market will restart towards the end of the year once a new Government will be appointed. Here are the key tax aspects of M&A in France.

Before the purchase of the asset (company or going concern)

Before buying a company or a going concern, a tax due diligence carried out by a law firm may be a worthwhile exercise to assess any potential tax risks and to ascertain the usual tax burden.

At the time of purchase of the asset: transfer taxes

Registration fees are payable by the buyer and depend on the nature of the asset purchased:

| Asset purchased | Tax rate |

| Shares in joint stock companies (SA, SAS) | 0,1% |

| Shares in other companies (SARL, SC…) | 3% |

| Going concern (“fonds de commerce”) or clientele | From 3% to 5%[2] |

| Shares in a company with a with a preponderance of real estate assets (SCI…) | 5% |

| Real estate asset | About 5,80% |

Changing the form of the company (from a SARL to an SAS, for example) before a sale or merge the operating company with the real estate company can save costs (but certain conditions must be met to avoid the tax authorities considering that there has been an abuse of rights).

While the asset is held

- Corporate income tax (CIT): The standard corporate income tax rate in France is currently 25% (compared with 33.3% in 2016).A reduced rate of 15% exists for SME’s but only applies to the first 42,500 euros of profits and is only available to companies that are at least partly owned by individual shareholders.

- Interest deduction: There are rules limiting the deductibility of interest paid to affiliated companies, some of which stem from European directives (for example, the limit of 30% of EBITDA or 3 M€ per fiscal year). This aspect must be considered if a leverage buy out (LBO) scheme is envisaged for the acquisition.

- Dividends: In principle, dividends received by a company are subject to corporation tax at the standard rate. Fortunately, in practice the participation exemption regime most often applies. So, dividends from a subsidiary are subject to the effective rate of:

- 1,25% (25% CIT rate applied to a flat rate base of 5%) or

- 0,25% (25% CIT rate applied to a flat rate base of 1%) whether the subsidiary is tax consolidated or meets the conditions for tax consolidation.

- Withholding taxes (WHT): dividends, interest, and royalties paid by a French entity to a foreign entity may be subject to withholding taxes. However, France has an extensive network of double taxation treaties that can reduce or eliminate these taxes, depending on the treaty provisions. For example, under the tax treaty between Poland and France, dividends are subject to a maximum withholding tax of 5%, provided that the subsidiary is owned at least 10%. European directives also provide for the elimination of the withholding taxes under certain conditions.

- Tax incentives:[3] there are tax incentives, for example for research and development (research tax credit), for innovative companies or for intellectual property (patent box). A tax credit for companies investing in green industries was also introduced in 2024.

At the time of resale: capital gains taxes

The standard corporate income tax rate in France is currently 25%. However, the participation exemption regime for qualifying shareholdings (for example for a subsidiary) allows taxation of the capital gain at the effective reduced rate of 3% (25% CIT rate applied to a flat rate base of 12%).

For capital gains on shares, the double taxation treaty provides that they are taxable only in the State of which the seller is a resident (i.e. in Poland if the seller is resident in Poland).[4]

Furthermore, if the French company’s assets consist mainly of real estate located in France, the capital gain on its shares will be taxable in France.[5]

Example of the structuring of an acquisition by a Polish investor

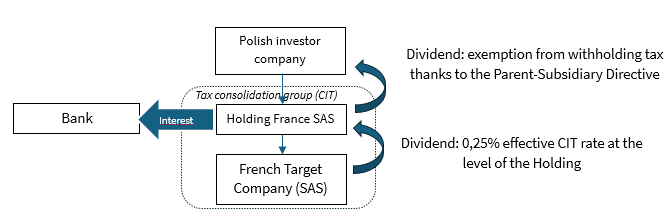

A Polish company wants to acquire a French operating company. The Polish company sets up a French holding company subject to CIT, “Holding France SAS”, to carry out the acquisition. Holding France SAS acquires the French operating target SAS for €10 million. To finance the acquisition, Holding France SAS borrows €8 million from a bank, complemented by an equity contribution of €2 million from the Polish company.

Once the acquisition was concluded, Holding France SAS opts for the tax consolidation regime for CIT, including the acquired SAS in its scope of consolidation. This system allows the holding company to offset the profits of the operating SAS against the interest it has to pay on the loan, thereby reducing its tax liability. For example, if the SAS generates a taxable profit of €3 million in the first year and the loan interest amounts to €0.5 million, the consolidated taxable profit would be reduced to €2.5 million (provided that the conditions for interest deductibility are met). This structure enables the Polish company to optimise tax benefits with the leverage effect while strategically integrating the French target SAS into its group.

This summary highlights the main tax issues at each stage of an M&A transaction in France, underlining the importance of tax planning to optimise the overall cost of the transaction. Our law firm is at your disposal for any acquisition or sale project in France.

[1] https://www.lesechos.fr/finance-marches/ma/fusions-acquisitions-le-rebond-du-marche-en-france-stoppe-par-la-dissolution-2104778

[2] After a rebate of 23,000 €.

[3] https://www.impots.gouv.fr/international-professionnel/tax-incentives

[4] https://www.impots.gouv.fr/sites/default/files/media/10_conventions/pologne/convention_avec_la_pologne_modifiee_par_la_cml.pdf art. 13 3.

[5] https://www.impots.gouv.fr/sites/default/files/media/10_conventions/pologne/convention_avec_la_pologne_modifiee_par_la_cml.pdf art. 13 1.